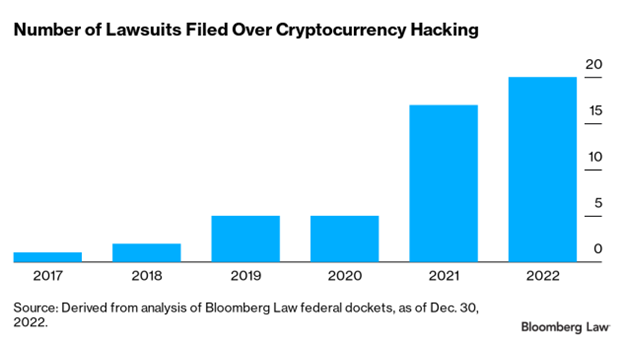

The number of lawsuits against cryptocurrency companies reached a new high in 2022. Victims of hacking are using a variety of legal claims to recoup their losses from crypto exchanges, digital wallet providers, and mobile service companies following cyberattacks.

Legal cases involving crypto hacking have been brought against companies like Apple Inc., Coinbase Inc., Gemini Trust Co. LLC, and AT&T Inc.

Source: Bloomberg Law

Most of these lawsuits are targeting two kinds of companies: crypto trading exchanges and virtual wallet providers. The lawsuits allege that companies’ security measures were inadequate to protect user accounts.

Over 90% of crypto litigation has taken place in federal courts, according to a recent study in the Southern Methodist University Science and Technology Law Review. The collapse of Sam Bankman-Fried’s FTX may bring crypto companies under even greater legal scrutiny.

Mobile service providers

An increasing number of cases have been filed against mobile service providers. Plaintiffs allege the carriers were responsible for the “SIM-swap attacks” that allowed hackers to steal cryptocurrency.

A SIM swap attack happens when criminals get hold of an individual’s cell phone number and transfer it to a new SIM card. Hackers may do this by accessing a mobile carrier’s systems through phishing attacks that convince its employees to install malware without realizing it.

Cryptocurrency trading exchanges and virtual wallets

The next most common litigation target is crypto trading exchanges and virtual wallets, which allow consumers to store their digital assets. Plaintiffs who suffered direct hacks of their accounts or wallets have filed lawsuits against the associated service providers.

Some of these legal actions are brought against “John Doe” defendants by a company or individual trying to identify exactly who stole their cryptocurrency. By filing lawsuits against unidentified persons, there’s an opportunity for civil discovery actions such as court-approved depositions and subpoenas to help a plaintiff identify and assign blame later down the road.

Promoters of crypto exchanges and currencies

An increasing target of crypto litigation are celebrities who have promoted cryptocurrencies or exchanges. In December 2022, a class-action suit was filed against celebrities, including Jimmy Fallon and Justin Bieber, for promoting Bored Ape Yacht Club NFTs.

Tom Brady, Gisele Bundchen and others were sued in November by an FTX investor for their endorsement of the platform.

Legal experts say these endorsements may be unlawful if they do fail to disclose the nature, source, and amount of compensation paid by the company in exchange for the endorsement.

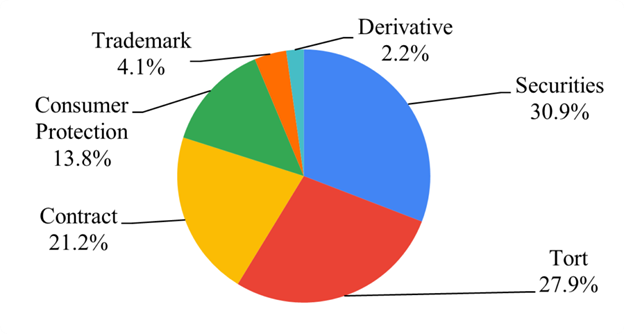

Types of claims

Common-law negligence is a common type of accusation in crypto litigation. This is an attractive legal option as it’s perceived as having a lower standard of proof.

Which federal statutes are cited in these cases? The most common one cited is the Federal Communications Act. This statute regulates telephone communications and is cited in most cases against mobile service providers.

Other cases make claims under the Computer Fraud and Abuse Act, a statute that provides a legal basis for arguing that digital data is protected property.

Chart: Crypto cases by cause of action for each year

Source: Yale J. Reg.

Obstacles to legal claims

Courts have put up some barriers to lawsuits against failed crypto companies and exchanges. In February, a federal judge dismissed a class-action lawsuit against Maker, a large decentralized finance protocol. The lawsuit alleged that investors suffered $8 million in losses because the platform misrepresented risks.

Judge Maxine M. Chesney (U.S. District Court for the Northern District of California) dismissed the complaint, writing that “Maker Growth Foundation is not a proper defendant because it has been dissolved, and therefore lacks capacity to be sued.”

The future of crypto litigation

We expect to see more litigation against crypto companies. Why? The cryptocurrency market is largely unregulated, and most of the cases rely on novel legal theories. Also, there have not been any major court rulings thus far. Until regulators or policymakers step in and clarify the law in this area, victims of crypto hacking will continue pursuing aggressive legal strategies to recover lost funds. Sidespin Group can help assess and support cryptocurrency litigation.

No tags for this post.